Table of Content

- Does Assuming A Loan Take The Previous Owner’s Name Off The Mortgage

- Can a Cosigner Transfer a Deed Without Refinancing?

- Cons of a mortgage loan take over

- What is a non qualifying assumption?

- Assumable Mortgage 101: How to Let Someone Take Over the Mortgage Payments on a Property

- Common FHA Questions

- Qualifying to Assume the Mortgage

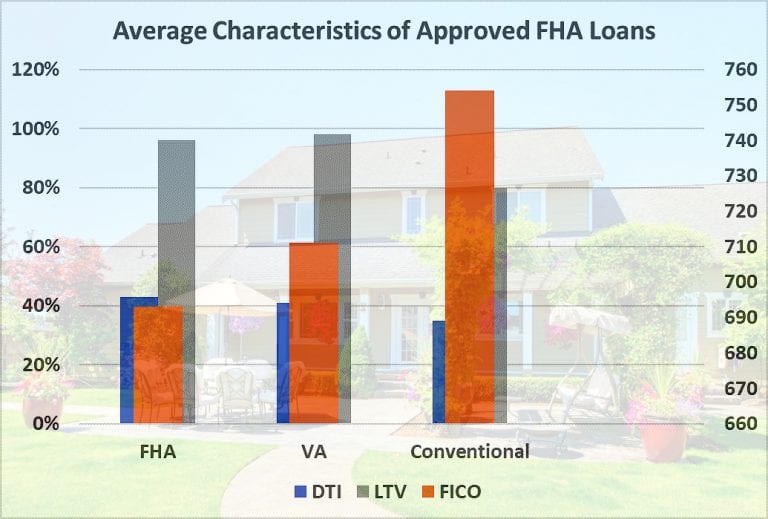

You’ll also need to include a real estate agent agreement and paperwork with a title company. After submitting your application packet, prepare to wait for an answer from a senior loan processor, who may call you with follow-up questions. To qualify for an assumable mortgage, lenders will check a buyer's credit score and debt-to-income ratio to see if they meet minimum requirements. Additional information such as employment history, explanations of income for each applicant, and asset verification for a down payment may be needed to process the loan.

If you need to make a down payment, then you should figure out how to come up with the money. You will have to pay the owner for the equity that he already has in the property. You’ll have to pay closing costs on a loan assumption, which are typically 2–5% of the loan amount. You’re limited to the current lender – If you’d like to assume a mortgage, you must still apply for the loan and meet all of the lender’s requirements as if the loan were newly originated. When interest rates rise, an assumable mortgage is attractive to a buyer who takes on an existing loan with a lower rate.

Does Assuming A Loan Take The Previous Owner’s Name Off The Mortgage

VA loansclosed before March 1, 1988, are assumable without conditions for the buyer. These are commonly referred to as freely assumable loans and no funding fee is assessed on these loans. It’s important to note that the seller of these loans can remain responsible for the mortgage if the buyer defaults on payments. It is strongly urged a veteran request a release of liability from VA in these cases. A veteran must request approval form the VA to have their entitlement restored to use on another VA loan. The final decision over whether an assumable mortgage can be transferred is not left to the buyer and seller.

These loans are assumable only by applicants with a FICO score of at least 600. In this case, the buyer must go through the same approval process he or she would for a new FHA mortgage. In addition, with assumed debt, the new borrower doesnt have much room to control the amount of their down payment, since the existing debt is already in place. However, if prepayment penalties have expired, the borrower may want to partially pay down the debt to reduce the total loan amount. While these conditions may not be ideal, there is no real drawback of having assumability as an option because buyers can elect not to use your debt.

Can a Cosigner Transfer a Deed Without Refinancing?

In the right situation, there can be big benefits to taking on an assumable mortgage. But this strategy won’t work for everyone, so it’s important to understand the pros and cons before signing on. In practice, though, assumable mortgages are a little more complex. They’re not exactly a free pass for someone who’s having trouble qualifying for a new loan. In these cases, the person who assumes the loan must prove the ability to make the monthly payments. This is the biggest advantage of an assumable mortgage since it allows the buyer to access a rate that could otherwise be unachievable in the current market.

This means the lender will repossess the house, and the family will no longer have access to it, even if they inherited the property when the veteran passed away. Keep in mind that the average loan assumption takes anywhere from days to complete. The more issues there are with underwriting, the longer you’ll have to wait to finalize your agreement.

Cons of a mortgage loan take over

Because a buyer assumes the same terms as the existing loan, they can take advantage of a locked interest rate which might be lower than the current loan rates. Mortgage assumption can be a valuable option for those looking for the possibility of a lower interest rate and a simpler home buying process. If you’re willing to take the risk and put trust in your new home’s seller and their lender, there’s a chance the path to homeownership could end up being a lot less of a headache. Sometimes assuming a mortgage is a result of the death of a family member or a divorce. In these cases, the lender will need to make sure that the person responsible for the loan still meets the minimum requirements they’ve set. The cost to assume a mortgage loan varies from home to home.

A home equity loan is a common second mortgage option for buyers who are assuming a mortgage and don’t want to — or can’t — put cash down to cover the equity. Although this second loan will likely have a higher interest rate than the assumed mortgage, the principal amount will be far lower than what is needed for a “first” mortgage. If you’d like to assume a mortgage, you must still apply for the loan and meet all of the lender’s requirements as if the loan were newly originated. That restriction limits your choice of a lender to the seller’s loan servicer.

You can then start over with a new mortgage in a home that fits your life as a single person. While purchasing a new home might not offer you the security you have in your existing home, it is a good way to start your new life. By buying a separate property with a new mortgage, you do not have to worry about removing your spouse from the loan or title documents. Lower interest rates mean higher savings for buyers, potentially in the thousands. Plus, without the need for an appraisal, buyers have the option of pocketing a few hundred dollars instead of paying additional fees. While most lenders are compassionate towards your situation, not all lenders are equipped to deal with loan assumptions properly.

The above-stated law clearly states that the spouse of a service member can assume a VA loan from their beneficiary if both were jointly liable to the loan. A security interest in household appliances for purchase money was created in the assumption. The assumption occurred as a result of a spouse/child becoming a joint owner of the property. The assumption did not require the transfer of rights of occupancy, and the owner remained the beneficiary. In the event of the borrower’s death, the loan was assumed by a relative.

She holds a bachelor’s degree in journalism with an emphasis in political science from Michigan State University, and a master’s degree in public administration from the University of Michigan. Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. It's best to speak with a Home Loan Expert before you agree to assume a loan. This article will give you an overview of how to assume a VA loan. Jeannine Mancini, a Florida native, has been writing business and personal finance articles since 2003.

This applies to home buyers specifically searching for assumable VA loans as well. There are a number of online resources for finding assumable mortgage loans. The original owner or new owner must pay a funding fee of 0.5 percent of the existing principal loan balance. This means that veterans and non-veterans could assume a VA home loan.

No comments:

Post a Comment