Table of Content

"Wells Fargo Home Lending will temporarily stop accepting applications for all new home equity lines of credit after April 30," the bank said in a statement. Wells Fargo, one of the largest home lenders in the U.S., said it it stepping away from the market for home equity lines of credit because of uncertainty tied to the coronavirus pandemic. Finder monitors and updates our site to ensure that what we’re sharing is clear, honest and current.

Out of 170 reviews, 70% of those reviews gave Wells Fargo an overall 4-5 star rating whereas only 19% respondents gave Wells Fargo a 1-2 star rating. It is often praised for its personalized customer service, low rates and convenience — while on the other hand consistent complaints have risen from people in regards to hidden fees. If you are looking for cash to do renovations, invest in a second property, or simply need to consolidate debts the flexibility that Wells Fargo’s HELOC offers can be hard to beat. Take the time to consider if a home equity loan or HELOC is right for you and look at rates you can get from competitors.

Pay by phone

Use your home equity line of credit to finance home improvements that may boost your home’s value and make your home more enjoyable. Transfer funds to your other Wells Fargo accounts with Wells Fargo Online®. This allows you to take advantage of whichever property you can get the best LTV for. Typically, home repairs and renovations make the most sense.

The payment reduction may come from a lower interest rate, a longer loan term, or a combination of both. By extending the loan term, you may pay more in interest over the life of the loan. By understanding how consolidating your debt benefits you, you will be in a better position to decide if it is the right option for you. Refinancing your mortgage can allow you to access available equity by taking cash out.

Personal loans

Retain quick access to available credit for unexpected expenses or major purchases. A great agent can also help you find deals and investment opportunities that will fit your budget based on how much of a home equity loan you qualify for. Leveraging your existing home equity to start or expand your investment portfolio, or to invest for retirement, can be a wise idea. Clever’s Concierge Team can help you compare local agents and negotiate better rates. The amount you owe on your loan divided by your home's original value, which is either the price you paid for it or the appraised value at closing, whichever is less.

The lender also covers the closing costs, and charges no annual or early payment fees. With our automatic mortgage payment options, you can schedule recurring withdrawals timed to match your paycheck cycle. As a privately held, independent community bank, we are able to make decisions promptly in our local offices. This provides our customers with a fast and convenient level of service. If you have any questions regarding our real estate lending services, please contact one of our experienced lending specialists at the locations listed above for more information. It's a good idea to plan for end of draw when you first open your home equity line of credit.

How can I use my Home Equity Line of Credit?

HELOCs allow borrowers to spend as much or as little of their credit line as they choose and may be a riskier option for people who can’t control their spending compared to a home equity loan. In addition to Investopedia, she has written for Forbes Advisor, The Motley Fool, Credible, and Insider and is the managing editor of an economics journal. BMO’s home equity loans have a higher APR than the national average, but the bank offers a slightly speedier timeline with about 30 days to close. BMO also has a slightly higher CLTV and offers loans as small as $5,000, all of which might put it in the sweet spot for some borrowers. Discover makes its home equity loans available to borrowers with the lowest credit scores among the national lenders surveyed.

Wells Fargo takes care of the closing costs, and you won’t need to bring cash to the table. As of May 2022, Wells Fargo temporarily put its home equity line of credit program on pause due to the uncertainties in the housing market during the coronavirus pandemic. Wells Fargo stopped accepting new applications after April 30, 2020. You can visit any Wells Fargo branch to make payments to your home equity account or to set up recurring payments.

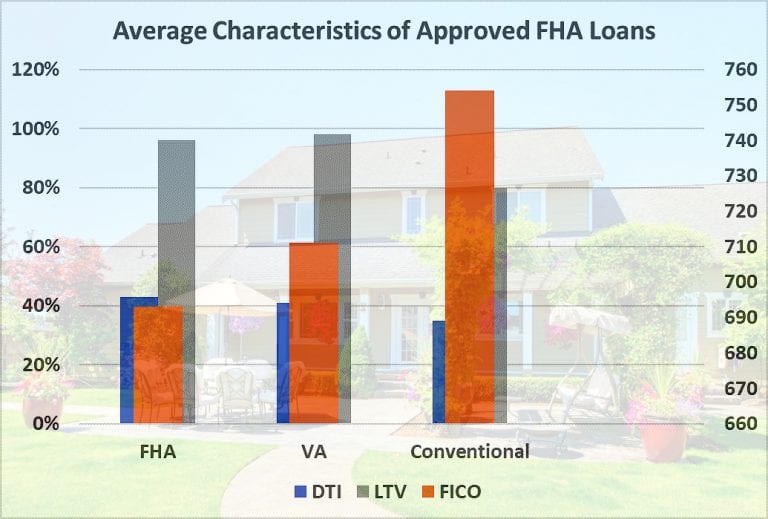

A financial obligation a borrower pays to either the FHA or a private insurer to insure the mortgage lender against loss from a borrower’s default. Upfront and monthly mortgage insurance is required on FHA and monthly mortgage insurance is typically required on conforming loans when the down payment is less than 20%. Wells Fargo HELOCs are a revolving credit that you can borrow against and pay back as many times as you want during the loan’s draw period. A draw period is the length of time you have to draw on the loan.

Start with our refinance calculator to estimate your rate and payments. Wells Fargo also looks at other debt on your credit report. This lender will not give you a loan if it would make your total monthly debt payments higher than 43% of your monthly pre-tax income. $500,000 is the highest possible credit limit for this type of loan from Wells Fargo.

The best rates are reserved for customers who set up automatic payments from their Wells Fargo checking account. Wells Fargo urges you to, “Please consider one of the borrowing options below.” And it goes on to suggest a cash-out refinance or a personal loan as alternatives. Wide range of alternatives, including cash-out refinance mortgages and personal loans. Your Wells Fargo home equity account is a powerful tool that can help you achieve your financial goals.

Home equity is the calculation of a home's current market value minus any liens attached to that home. A home equity loan is a consumer loan allowing homeowners to borrow against the equity in their home. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.